Online and e-commerce business is booming in India. From mobile smartphones to medicines, everything is available online for purchasing. But if you are running an e-commerce business in India, it might get difficult for you to select the best payment gateway for your business.

But you don’t have to worry more as I have curated the list of the 20 best payment gateways for India.

You can surely rely on any of these payment gateways for all your e-commerce transaction.

Best Payment Gateways In India

1.Razorpay

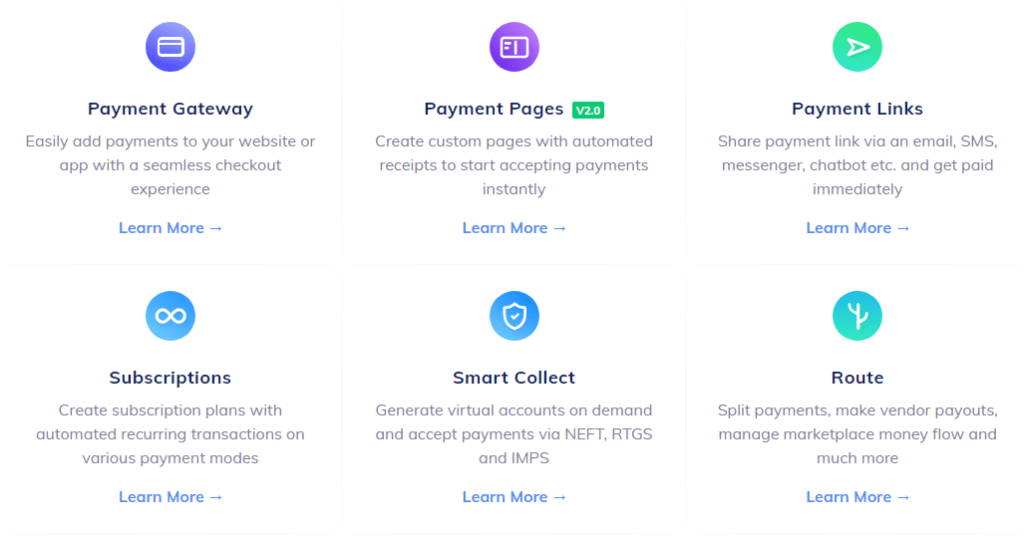

When talking about the best payment gateways in India, Razorpay has to be on top of my list. Founded by IIT Roorkee alumni, Razorpay will allow you to accept payments from customers, make payments to vendors and employees and so much more.

It also allows you to set up a payment gateway system and payment pages all at ease. You can also create your own custom payment link and send it to your customers via SMS, messages, Whatsapp, chatbots, and other communication mediums.

To date, more than 50,000 local businesses, small-scale startups, and large MCNs are using Razorpay.

Check out the reviews below:

Features;

- Offers 100+ payment models.

- Instant activation.

- Dashboard and reporting.

- Excellent customer support.

- Cheap and affordable.

- 100% safe and secure.

Pricing;

Razorpay charges 2% platform fee along with *GST applicable. Instruments like Diners and Amex Cards, International Cards, EMI (Credit Card, Debit Card & Cardless) & Corporate (Business) Credit Cards will be charged at 3%.

2.Instamojo

The next on this list of Indian payment gateways is Instamojo. This is a new-age payment gateway solution in India that is specially built for SMEs in India. One can integrate Instamojo with any website and any stack which makes it easy to use and flexible.

It has also got an Android SDK so that you can collect payment via your Android app.

If you are running an online business, then you know the importance of having a smooth and fast payout process. Instamojo is optimized for both mobile and web, and it promises your customers a quick and smooth checkout experience.

Check out the reviews below:

Features;

- Analytics dashboard to track sales and customer insights.

- Get payments tools like Khatabook, payment retry app, and a lot more.

- 100+ payment modes accepted.

- Multi-channel payment collection.

Pricing;

Instamojo charges 2% of every transaction + Rs 3

3.Cashfree

If you are looking for the fastest, safest, and easiest way to collect payment for your business, then Cashfree is the solution that you need. One of the best features that I personally loved about Cashfree is that it accepts domestic and international payments with 100+ payment options.

So, with Cashfree you can also accept payments from international customers easily.

It has also got a range of API integrations that allows you to accept payment in multiple currencies, connect with Paytm and Paypal, integrate it with the website or mobile app.

Check out the reviews of their customers below:

Features;

- Same-day settlement.

- 100% safe and secure.

- Complete analytics dashboard.

- Go global and accepts payment from international customers.

- 100+ payment modes.

Pricing;

The pricing of Cashfree is very cheap as compared to other payment gateways in India. It only charges a 1.75% fee for the transaction.

4.Bill Desk

Founded in the year 2000 bill desk is one of the oldest payment gateway companies in India. It is also one of the most popular and widely used payment gateways in India.

One of the best features of this company is that it allows you to track the status of all your current bills and payments in one easy-to-read format. It also allows you to schedule the bills and payments.

For example;

You want to make a payment of your wifi bill the day after tomorrow. But on the same day, you have an important meeting with the client and you might be busy the whole day.

In such a situation, you can easily schedule your payment on Bill Desk and attend your meeting with a free mind.

The only downside of Bill Desk is that they don’t have an intuitive website. Additionally, their website shows errors many times while making payments.

Features;

- Bill scheduling.

- 24*7 customer service.

- One-click and auto-pay.

- Electronic tool and analytics account.

- 100% safe and secure.

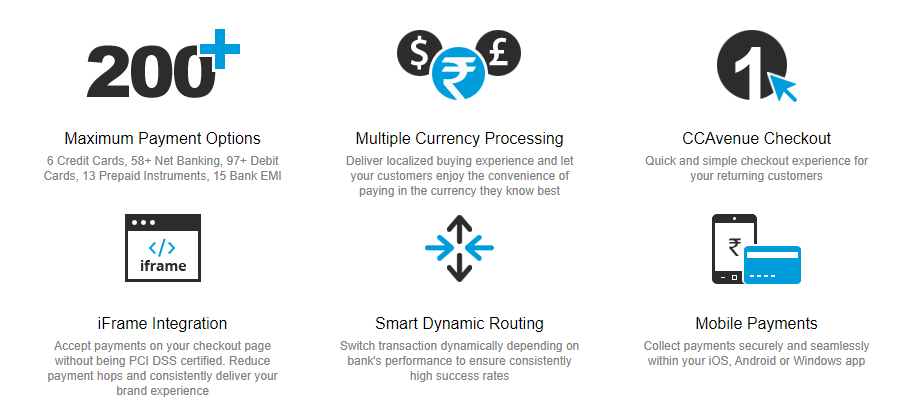

5.CCAvenue

You have expanded your business in foreign countries and looking for solutions for accepting international payments at a cheap rate. If you are one of those then CCAvenue has got you covered.

This Indian payment gateway will allow you to accept payment in 27 major foreign currencies and allow your customer to pay in the currency they know best.

That’s cool, right?

You can also create a separate payment landing page in regional and international languages with help of CCAvenue. For example; most of your customers live in Maharashtra and they know only the Marathi language.

In case you can create a payment landing page in the Marathi language with CCAvenue free of cost. This will surely take your conversion to the next level if you are a local business owner.

Features;

- Maximum payment options.

- Get a multilingual payment page.

- Create a website builder.

- Card storage volt.

- iFrame integrations.

- Shopping cart plugins and so much more.

Pricing;

It charges 2.00% * fees on all domestic transactions and 3% fees on all international transactions.

6.Paypal

Now here comes my personal favourite payment gateway in India which is Paypal. I have been using Paypal since I started my blogging career. I am totally satisfied with its services except for its high transaction fees for receiving international payments.

Currently, Paypal is the market leader with more than 346 million accounts active on the platform.

As of now, Paypal offers two various payment gateway options in. first, the free option allows your customers to enter their payment details on a secure, PCI-compliant template hosted by PayPal.

Second, is a paid option that is fully customizable, so you can build a checkout experience as unique as your business. These options cost $25 per month and best suitable for large-scale businesses.

Features;

- Advanced fraud protection services.

- Buyers authentication.

- Recurring billing.

- Simply compliances and tracking.

- More payment options.

- Invoice generator and a lot more.

Pricing;

7.EBS

Today, majority of the online transaction fails because of expired cards, insufficient balance, wrong passwords, etc. And refilling the payment details once again can be a time-consuming job.

This might also hamper your conversion rates.

So, a way out of this situation would be the auto-refill option. This option will direct the customer to an intermediary page where they can either choose to continue using the same payment mode or alternate payment mode to complete the purchase successfully.

This can reduce your cart abandon rate and increase the conversion rate by 10-12%.

So, if you are looking for a payment gateway in India with such a feature then EBS should be your choice.

Features;

- Payment page customization to the new level.

- Multilingual payment page just like CCavenue.

- Merchant account activation in 24 hours.

- Autopay and multibank EMI option.

- Analytics and reporting tools.

- Single admin interface.

Pricing;

Transaction fees for the domestic payments is 2.00% and 3% for the international payments.

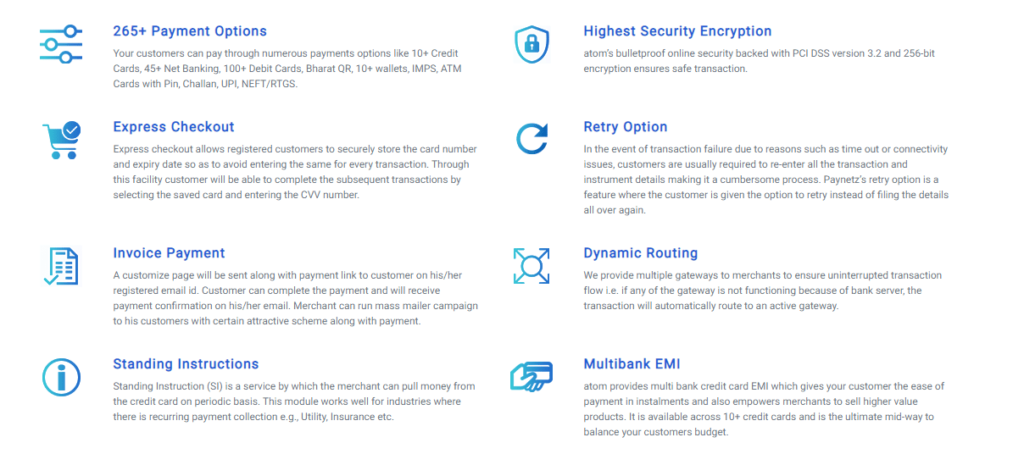

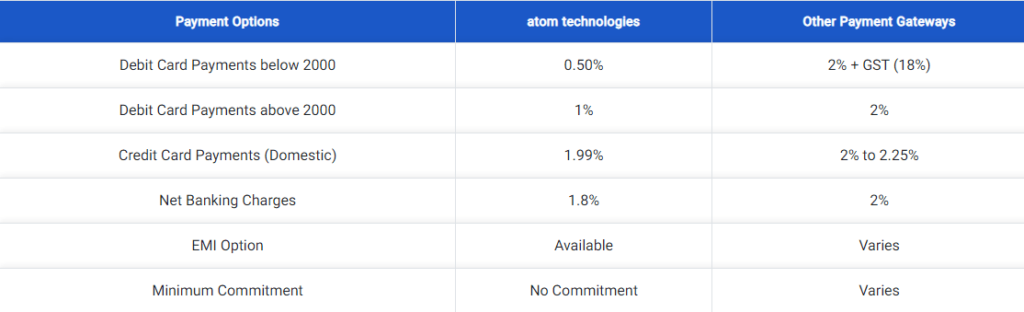

8.Atomtech

If you are hunting for the safest and secure payment gateways in India, then Atomtech is waiting for you. Atom’s bullet-proof security is backed by PCI DSS 3.2V compliance and is 256-bit encrypted, ensuring 100% safe and secure transactions.

There are more than 250 payment options available with Atomtech. Plus, they have also integrated with 50+ banks while keeping up and equipping you with the latest payment technologies.

You can also accept international payments with Atomtech at ease.

Talking about integrations, then Atomtech can integrate with kits for websites & mobile apps for more than 25 platforms.

Features;

- 24*7 customer support.

- Easy payment processing.

- Secure payment.

- Multi-currency payment option.

- Easy integration with 25+ platforms and more.

pricing;

9.PayKun

The above-mentioned payment gateways in India charge at least 2% or 3% transaction fees excluding taxes. I know, this amount can be quite hefty if you have low-profit margins.

So, if you are looking for cheap and reliable payment gateway companies in India, then PayKun is the best alternative of above all.

PayKun only charges 1.75%+ taxes as transaction fees. This makes them one of the cheapest payment gateway providers in India.

Moreover;

PayKun Payment Gateway is designed in such a way that it ensures online payment is safe and secure for both customers and sellers.

Features;

- Buyer and seller protection.

- Speedy onboarding.

- Free integrations assistance.

- Cheap and affordable.

- 120+ payment options.

Pricing;

1.75% transaction fees on UPIs and Debit cards, 2% on credit cards, and 3% of international cards.

10.PayTM

With a market share of 14.8%, PayTM is the 3rd most popular UPI payment gateway in India. It comes with a Java Script checkout which is a 2 step check-out process and can be easily integrated on your website.

It also gives multiple payment options like Debit/Credit Cards, Net Banking, EMI UPI & Paytm Wallet, and more. It gives a plethora of payment options to your customers.

I also know the feeling of excitement when you get an instant cash settlement in your bank. With Paytm’s real-time bank settlement, your bank account will be credit as soon as the payment is done.

Cool, right?

As of 2020, PayTM had more than 450 million users and 250+ saved cards.

Check the reviews:

Features;

- Zero setups and maintenance costs.

- Analytics dashboard.

- Get account manager.

- Migration assistance.

- 24*7 support.

- Tons of payment options.

Pricing;

Paytm gateway charges 0% transaction fees on the UPI payment. It charges 1.99% on credit card and net banking, 2.99% of international PG, and 0.4%-0.9% for debit cards, visa, and master cards.

11.DirectPay

Did you know?

Over 40% of the online transactions do not get completed. This means, there is a huge gap between customers purchasing a product and making a payment for the same.

This is where DirectPay comes into the picture.

This payment gateway in India gives you real-time alerts of specific transactions not being completed. This also gives you an opportunity to immediately connect with the customer to not only ensure that the transaction is completed but also make sure that the customer does not go to the competition.

Features;

- Single gateway for various payments.

- Multiple access modes.

- Payment alerts.

- Saving on infrastructure.

- T+2 fund settlement.

12.PayUbiz

The next on this list of the best 20 payment gateways in India is PayUbiz. When it comes to integrating payment gateway on a website or application, most businesses find it a scary task and think too many technicalities and coding work might be involved.

But PayUbiz is apart from other such payment gateways in India.

It has a developer-friendly API and SDK that will allow you to seamlessly integrate with PayUbiz with just a few lines of code on your website or app.

It also has a white-labelled card vault, so that your customers can save the card data safely and securely for their next payment while they purchase from you.

Features;

- International payment acceptance.

- Email SMS and invoicing.

- EMI options are available.

- E-commerce plugins and a lot more.

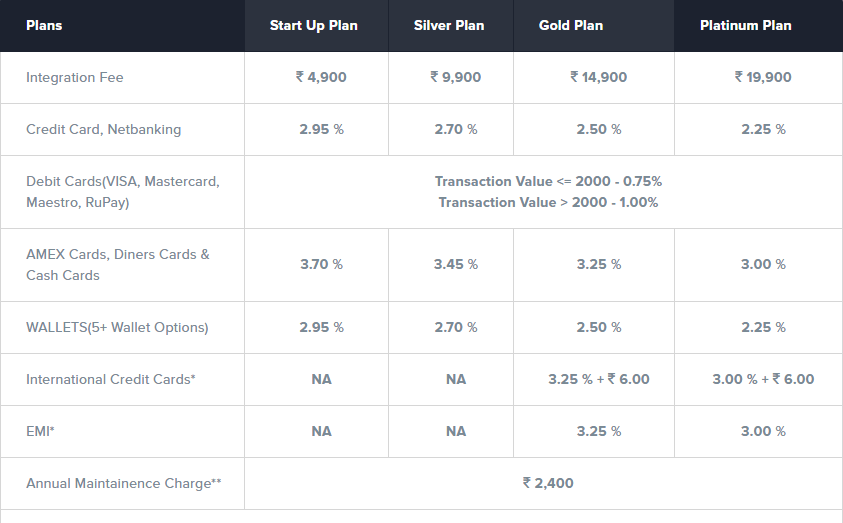

Pricing;

13.PayUMoney

Used by 3.5+lakhs businesses, PayUMoney is yet another payment gateway in India. Whether you are running an online store via the website or a mobile app, PayUMoney has got a payment solution for both.

It also has a smooth and appealing UI for checkout pages that will boost your conversion and sales.

Do you want to accept money from foreign clients and customers?

Worry no more, as PayUMoney accepts payment outside India in 100+ foreign currencies.

Features;

- 100+ payment options are available.

- World-class security.

- Integrate payment on different platforms.

- Powerful dashboards to manage your transactions.

- Developer friendly.

Pricing;

It charges a transaction cost of 2% + GST on every transaction for various modes of payments such as debit cards, credit cards, net banking, wallets, etc. 3% for American Express and international cards.

14.Mobikwik’s Zaakpay

This is a payment gateway in India started by Mobikwik, an e-commerce payment system company.

Zaakpay is best known for its link payment system and QR codes. You can easily generate the payment link from your dashboard and send it to your customers via email, SMS, messages, or chatbots.

The platform has got easy to use interface which makes it easy even for a newbie to use it.

Zaakpay can also be integrated with CMS websites built on WordPress, Magento, Woocommerce, Open cart, and more.

Features;

- Link payment available.

- UPI, debit, and credit cards payment are available.

- Accept international payment.

- Get payments from 50+ banks.

- Zero transaction fees for the first month.

Pricing;

2% transaction fees on all Indian credit & debit cards, net banking & wallets and 0% on UPIs.

15.EaseBuzz

EaseBuzz is a payment gateway company in India that has empowered 50,000+ businesses to accept payment online and go digital.

Started with a mission to digitize the informal sector and help businesses manage receivables and payables, EaseBuzz’s payment gateway solution works on the “SMART” business model.

- S for Simple, secure, and scalable.

- M for Mobile money.

- A for Advance analytics.

- R for Robust and rapid.

- T for Tax accounting and tech support.

Today, the majority of small-scale businesses find if difficult to understand advanced accounting concepts like GST, government taxation laws, and other financial guidelines.

With EaseBuzz, you no more have to worry about all these.

Easebuzz simplifies the overhead of tax calculations (GST compliant) and enables the merchant to generate the invoice online and share with customers using mediums like Whatsapp, SMS, mail etc.

Features;

- 100+ payment options are available.

- Settlements happen in “T”+ 1 working day for all payment modes.

- 3+ Platform SDK, 5+ eCommerce plugins, many server integrations available.

- Smart dashboard and advanced analytics to track all your payment processes.

- Seamless experience on any device.

- Simple, secure and 100% authentic.

Pricing;

1.9% flat fee* on every transaction.

16.Sbiepay

Looking for payment gateways in India by PSU banks?

SBIePay has got you covered. SBI is the largest PSU bank in India and also the only bank in India to have its own Payment Gateway integration. This payment gateway system is widely popular among central and state government bodies, educational institutes like colleges, private coaching classes and more.

Being owned by the largest government bank in India, SBIePay is 100% safe and secure.

It has got security approvals from PCI-DSS V3.2 and SSL certification which makes them reliable and trustworthy in the market.

Features;

- Tons of payment options available.

- International payment acceptance.

- 100% safe and secure.

- Cheap pricing.

17.HDFC

If government-owned banks in India have payment gateway solutions, then how the private banks left behind.

HDFC bank has payment gateway solutions for merchants and small businesses. You’ll get an MPoS application that is installed on your phone so that you can accept and process card payments.

The only downside of this payment gateway is that it cannot be integrated with the website.

Features;

- Customers just need to swipe their cards for instant payment.

- EMI options can be given to the customers.

- International payment accepted in 16+ currencies.

- Dedicated support team.

- 99.9% uptime guarantee.

Pricing;

Contact bank services for more information.

18.ICICI Bank

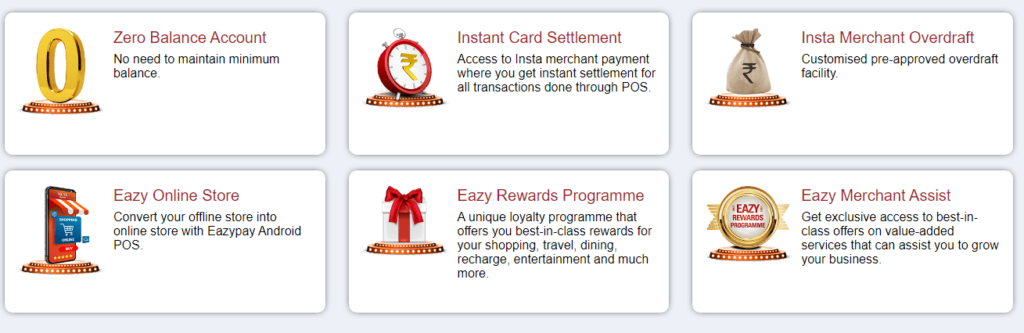

Now let me introduce the best payment gateway in India by a private bank. ICICI’ Banks super merchant account comes jam-packed with easy, quick and instant collection solutions.

No matter what type of business you run, you can integrate the payment gateway solution by ICICI bank and take your business to the next level.

What’s more?

This payment gateway by ICICI bank comes along with tons of value-added services that can assist you to reach more customers and grow your business.

Features;

- 150+ additional banking services.

- Instant overdraft facility is available.

- Eazypay POS through InstaBIZ.

- Bulk payment option available.

- Auto reconciliation.

Pricing;

The transaction fee charged by ICICI Bank varies. It is about 1.85% fee per transaction via Net Banking and Credit Cards. And 1.18% and 0.80% fee per transaction exceeding ₹2000 via Debit Cards and UPI respectively.

19.Payoneer

Helping businesses in more than 200+ countries, Payoneer’s payment gateway solution is the easiest to use and integrate. It gives you global coverage and a chance to collect payment in 150+ international currencies.

Other payment gateways in India as mentioned above in the list takes 2-3 days to process payments. But with Payoneer, you can be assured of getting your payment within 24-hours.

That’s instant speed.

Features;

- Global reach.

- Zero overhead costs.

- Easy to integrate.

Pricing;

When someone pays you via Payoneer there is 0 transaction cost involved. However, if you get paid by your client via credit card then 3% fees is applicable and 1% on ACH bank cards.

20.GoCardless

As you could conclude by its name, GoCardless is a payment gateway in India for those who are running global online businesses.

Do you know?

30% of the churn rate occurs because your payment fails and customers lose the product and services. But with the help of GoCardless, you can increase your 97.5% of the payment successfully for sure.

They have a payment failure rate of only 0.4% which sets them apart from other payment gateways in India.

Features;

- Can reduce 90% of your operation cost.

- Improve your conversion rates.

- Collect recurring payments.

- Get pre-built payment pages.

- API integration.

- ISO certified.

- Trusted by 50,000+ business

Pricing;

2% + $0.25 transaction fees for all the international payments. 1% + $0.25. Max $2.50 fees in the USA.

FAQs About India Payment Gateways

Payment gateway is an online service that allows businesses to process payment in national as well as international currencies all across the globe.

How does a payment gateway work?

A payment gateway validates the customer’s card details securely, ensures the funds are available and eventually enables merchants to get paid.

Razorpay and Paypal is the best payment gateway in India for international transactions